Resources

Publications

ASEAN Catalytic Green Finance Facility 2025: Turning Regional Ambition into Green Investments

This report summarizes progress made and achievements from January to December 2025 of the ASEAN Catalytic Green Finance Facility (ACGF).

Accelerating Thailand’s E-Mobility Transition: Policy Assessment and Action Plan 2025–2035

This publication outlines a policy assessment and action plan to advance a sustainable, low-carbon transport sector in Thailand.

Mobilizing Capital for Local Government Finance in Asia and the Pacific Through Green, Social, and Sustainability Bond Markets

This report shows how local governments can use green, social, and sustainability (GSS+) bonds to raise the cost-efficient capital they need to fund sustainable infrastructure projects.

ASEAN Taxonomy for Sustainable Finance - Version 4

The ASEAN Taxonomy for Sustainable Finance Version 4 contains comprehensive coverage of all six focus and three enabling sectors of the Plus Standard, complementing the Foundation Framework.…

Blogs and Multimedia

In the News

ADB approves over $80M for Cambodia’s clean energy transition

RI-Malaysia economic ties set for stronger growth: Finance Minister

AIIB, ADB, and AIF ink letter of intent to boost ASEAN infrastructure cooperation

ASEAN Infrastructure Fund Unveils 2025-2028 Action Plan

12th AFMGM Joint Statement

Activities

Powering Indonesia’s Clean Energy Transition

ACGF published a Catalytic Finance Story highlighting how Phase 1 of Indonesia’s Accelerating Clean Energy Transition Program (AICET) is scaling renewable energy and strengthening power system resilience through one of the largest blended finance packages in Southeast Asia. As ACGF’s largest energy-supported program to date, AICET mobilizes up to $1.1 billion in financing from ADB, the ASEAN Infrastructure Fund, and ACGF partners including Agence Française de Développement, KfW, the European Union, and the UK, anchored by $30 million in concessional cofinancing.

Advancing the Philippines’ Blue Economy Development

With support from ACGF, ADB approved a $500 million policy-based loan under the Marine Ecosystems for Blue Economy Development Program (Subprogram 1) to strengthen marine ecosystems and climate resilience in the Philippines. ACGF supported program preparation through targeted technical assistance to strengthen reform design and implementation readiness across key policy areas, while partners Agence Française de Développement and KfW will each provide up to €200 million in cofinancing. Capacity building for core policies was also supported by the e-Asia and Knowledge Partnership Fund.

Investing in Cambodia’s Resilient Urban Future

With support from ACGF, ADB approved the $763 million Livable, Resilient, and Water-Secure Cities Investment Program to strengthen water security, climate resilience, and urban livability across rapidly growing cities in Cambodia. The multi-tranche program is expected to benefit more than 2 million people in 14 cities and 12 districts, contributing to national goals for universal access to safely managed water and sanitation. ACGF mobilized $155 million in concessional financing from Agence Française de Développement, the ASEAN Infrastructure Fund, and the European Union through its Global Gateway, supporting climate-adaptive infrastructure investments, expanded access to basic urban services, and strengthened urban planning and utility capacity.

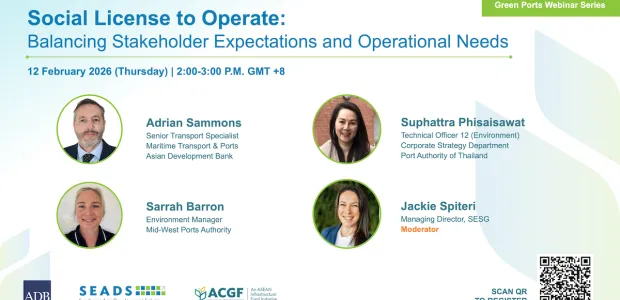

Smart, Clean, and Connected Ports: Advancing Port Decarbonization in Southeast Asia

ACGF convened the second session of the Green and Resilient Ports Webinar Series to examine how ports across Southeast Asia can advance decarbonization while maintaining efficiency and competitiveness along the maritime value chain. The webinar brought together regional and global experts to discuss the role of innovation, smart technologies, and collaboration in reducing emissions, improving air quality, and supporting sustainable port operations. The discussion highlighted how integrated planning, digital solutions, and green finance can help ports transition toward cleaner, more connected, and climate-resilient systems.

Mobilizing Private Capital for Sustainable Infrastructure in Southeast Asia

ACGF convened a regional webinar with ADB’s Private Sector Development department to examine how private capital can be mobilized at scale to support Southeast Asia’s development and climate goals amid growing infrastructure financing needs. The discussion highlighted how ADB and its partners are translating ambition into action through innovative financing instruments, guarantees, transaction advisory services, and policy support across clean energy, transport, and urban infrastructure.